On December 22, 2015, my brother and I purchased a home together. Here’s how $ 1000 turned into a down payment for our home.

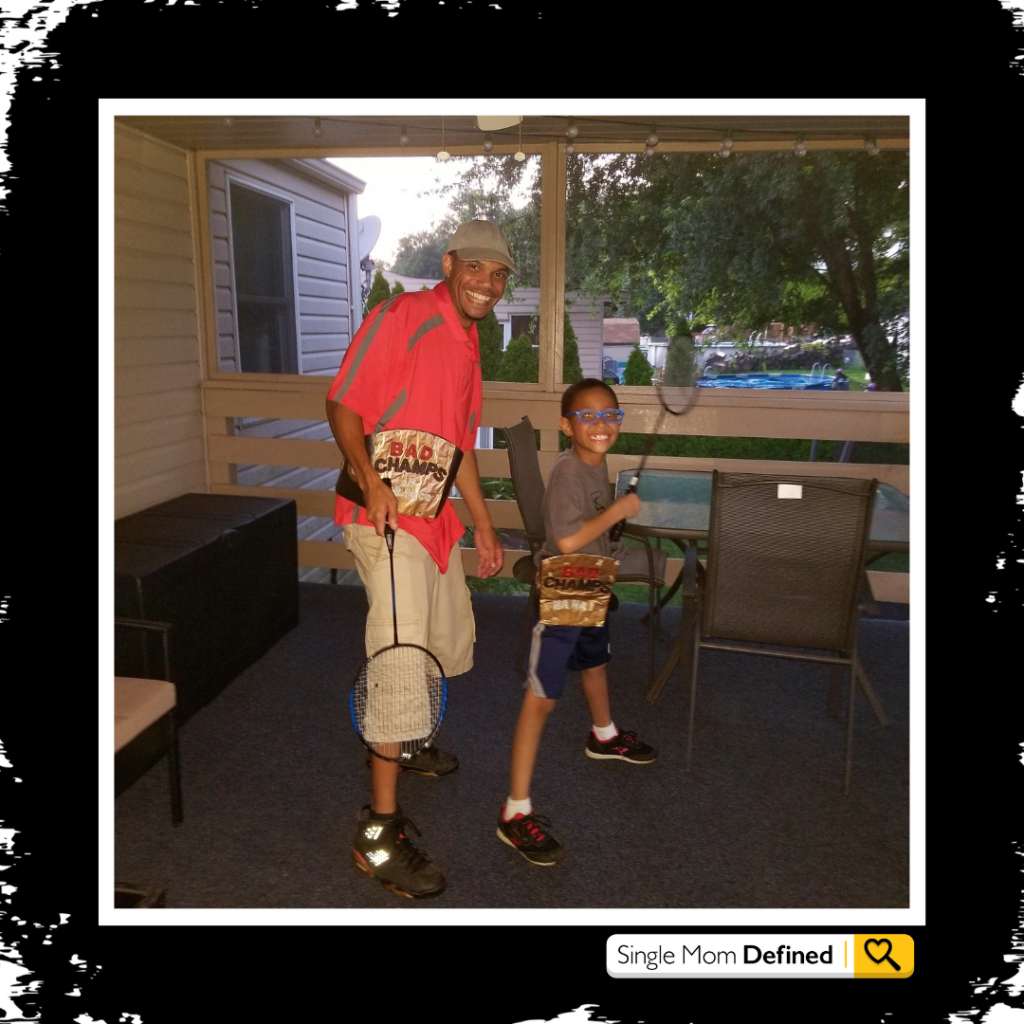

My brother and I lived in rented mobile homes in the Belle Vernon area. We spent over a thousand dollars apiece every month paying rent and utilities. He was raising his son as a single father, and I was raising both my sons as a single mom. Since we were at each other’s places all the time, helping one another raise our kids, I thought purchasing a home together would be more beneficial. When I came up with this idea, we lived paycheck to paycheck, and neither of us had any savings. Buying a home would be nearly impossible, so I gave it to God. I came up with this brilliant idea in July of 2015.

$1,000 Felt Like Winning The Lotto

In 2012, I left my previous employer to work for a contractor who would hire me out to the government. When I left the job, I was given a check from my 401K rollover plan. The check was approximately a thousand dollars since I had only been at the company for three years. As you know, I was living paycheck to paycheck while raising two children, so I viewed that check as hitting the lottery. I was extremely excited because now I could buy some things that the boys and I needed and “treat” ourselves for being so disciplined when it came to being on a budget.

Unfortunately, my new employer had set up a meeting with a financial advisor, aka the “money man,” and he had my check. I had decided that I would meet with him, and no matter what he would try to sell me, I wanted my money. That check was spent, so we did not need to meet to discuss other financial and investment options.

Avoiding Meeting With The Financial Advisor

Avoiding Meeting With The Financial Advisor

Due to my two-hour commute to work and being a single mom, I did not have time to meet with the “money man.” Every time he made an appointment, I would have to cancel because either I couldn’t get off work, I had a conflict in my schedule, or life just happened, and I couldn’t make time to meet. Eventually, he came to my home one late evening to meet with me, even though it was out of his way. He had stated he wanted to share some information with me, but he had no problem handing it over if I just wanted the check.

I agreed to meet with him, which would be his quickest meeting. When he came to my home, it was six in the evening. I had just picked up the boys (ages 3 and 7) from my mom’s. I was cooking dinner, helping my oldest with his schoolwork, getting things ready for the next day for the boys and myself, and dealing with the dog. Let’s say the evening was a bit chaotic. The “money man” arrived while the chaos was unfolding. Even though a lot was happening, he was patient, understanding, informative, and empathetic regarding my situation.

Ultimately, he convinced me to sign the check for his company and agreed that he would take care of everything for me. I advised him that I didn’t have an extra minute in my day to deal with any of this and told him I trusted him to do what was best for my family and me, and guess what? That’s what he did.

The Best $1,000 Decision I Ever Made

The Best $1,000 Decision I Ever Made

I had no clue that the “money man” had invested my thousand-dollar check within those three years. One day in 2015, he called to check in on me and the boys. He wanted to know how we were doing and asked if I had any questions regarding the account he had set up for me. I told him all that had happened in the last few years and that I had no questions regarding the account because I was unaware he had set one up for me. He laughed and said I send you correspondence all the time. I said, “Yes, I know, but I haven’t had time to focus on any of that because I have so many other things going on professionally and personally.”

He told me he understood but wanted me to know I could still trust him. He then asked me if I had any plans coming up. I told him I would love to buy a home with my brother. Then I explained to him how it would benefit my family for years. Still, unfortunately, I don’t have any money to put a down payment on a house, and neither does my brother.

How 1000 Turned Into The Down Payment For Our Home

How 1000 Turned Into The Down Payment For Our Home

The “money man” told me I could use the money he invested for me as a down payment on my first home. I laughed and said, “A thousand dollars is not enough to buy a home, but thank you for the information .” He said, “Sonya, I grew your money.” I had no idea what any of that meant. Long story short, I had forty thousand dollars in my retirement account. Since this would be my first home, I could take ten thousand dollars from my retirement plan without penalty and use it to purchase our home. I was in shock! I could not believe I even had a retirement account, much less forty thousand dollars. Or that I could take ten thousand dollars from the account without paying it back or being charged penalties for early withdrawal. I couldn’t believe what he was telling me. I instantly started crying.

That’s how 1000 turned Into the down payment for our home.

Learn more ways Single Moms Can Buy A New Home.